Access advice to guide your steps

Why Do Managed Fund Unit Prices Drop and Freeze on 1 July?

If you hold units in a managed fund, you might notice something curious at the start of each financial year: on 1 July, the unit price often drops sharply and may even be temporarily frozen. While this can seem alarming at first glance, it's actually a normal and expected part of the fund’s annual tax process.

What’s Happening Behind the Scenes?

Managed funds are required to calculate and distribute their net taxable income to investors each financial year. This includes:

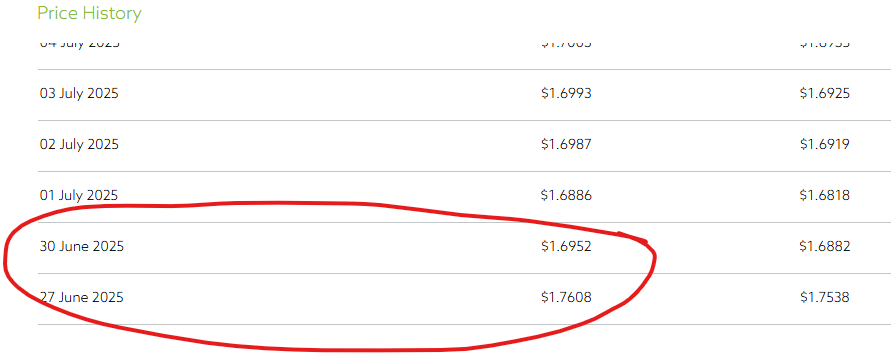

On 30 June, the fund works out your share of this taxable income based on how many units you hold. This income is then distributed to you, often not as cash, but as a reinvestment (more units) or reported as income for your tax return.

To reflect that this income has been distributed, the unit price is reduced by the same amount on 1 July. This drop doesn’t mean you’ve lost money — it simply reflects that part of your investment return is now being accounted for as a distribution.

Why Is the Unit Price Frozen?

In some cases, the unit price may be temporarily frozen on 1 July and for a few days after. This happens because the fund is finalising:

Once the fund completes its financial reporting, normal pricing resumes, usually within a week or two.

Real-World Example:

Let’s say you hold 1,000 units in the ABC Australian Equity Fund.

You haven’t lost value — instead, you now have either:

What This Means for You

This price adjustment is simply a tax accounting process and doesn't mean the fund has performed poorly. In fact, distributions are part of your total return. If you’re reinvesting, you’re using these distributions to buy more units at the new (lower) price — effectively compounding your investment.

Tip: If you receive large managed fund distributions each year, it’s worth checking whether you’ve got enough cash set aside for the tax you may owe. The distribution is assessable income even if it’s reinvested.

This website may contain general advice, but does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. In the event that Funded Futures Financial Services is providing personal advice it will be communicated via a ‘statement of advice’.

Funded Futures Financial Planning ABN 81 646 656 804 T/A Funded Futures Financial Services is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licencee # 512550.