Access advice to guide your steps

You may be debating between an apartment and a house if you are looking for real estate. Every alternative has advantages and disadvantages, and your choice will rely on your preferences, lifestyle, and financial situation. We’ll analyse some of the key factors that influence the worth and satisfaction of having a home vs an apartment in this post.

The land component is one of the most noticeable distinctions between an apartment and a house.

A plot of land that often goes with a house has a likelihood to increase in value over time and yield capital growth. In contrast, an apartment’s worth is mostly based on its location, amenities, and building quality rather than any land linked to it.

This implies that, particularly in locations where land is in great demand and rare, an apartment may have less potential for capital growth than a house. This does not imply, however, that investing in apartments is necessarily a terrible idea, apartments may be more convenient than homes and offer reduced initial and ongoing maintenance expenditures as well as a larger rental yield.

Apartments are frequently found in the heart of everything, near places to eat, shop, transport, and entertainment. Additionally, they can include security features like swipe cards, CCTV cameras, and intercoms. Additionally, some units provide access to common areas including gardens, gyms, pools, and BBQ pits.

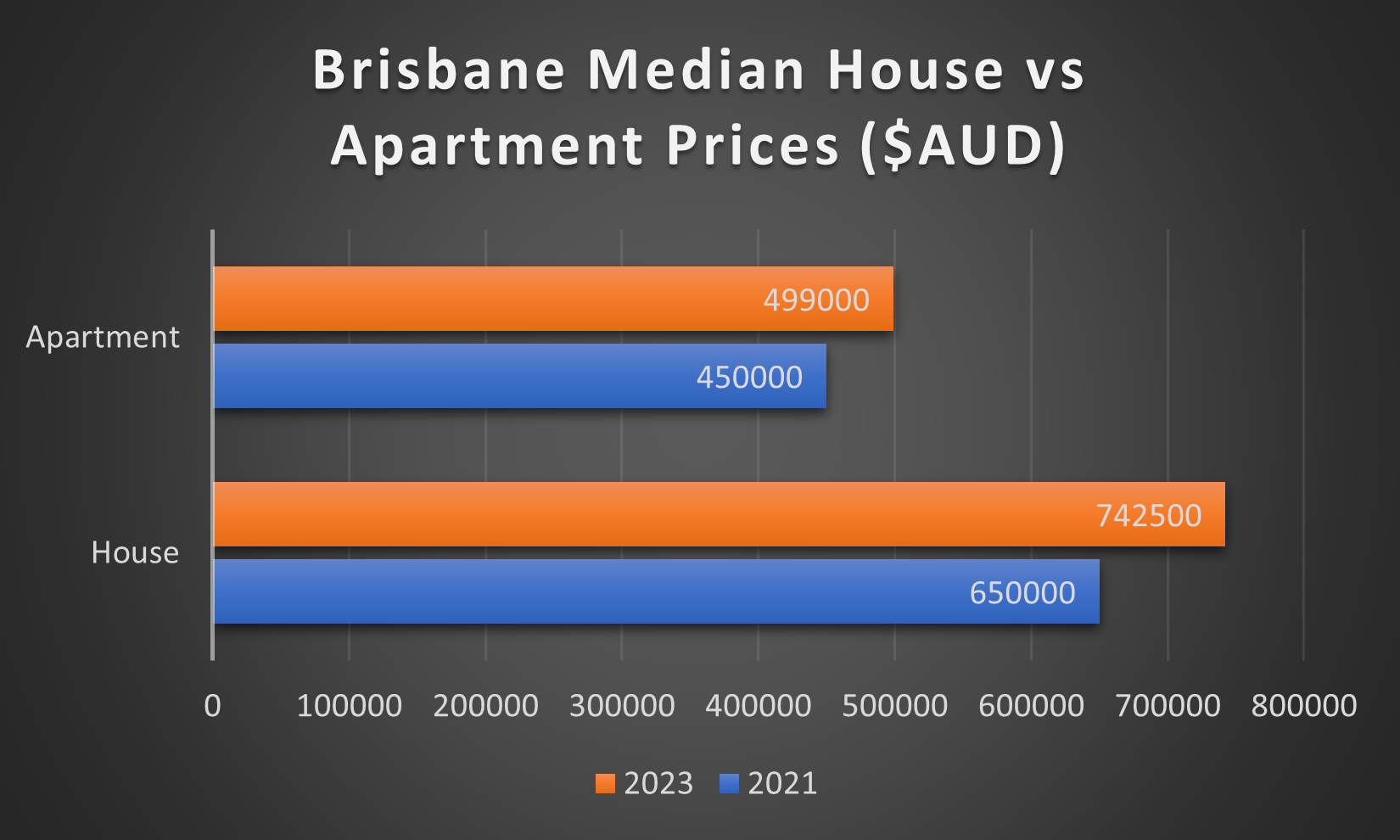

Brisbane had a nearly 15% increase in house prices, rising from $650,000 in 2021 to $742,500 in 2023. According to this article, Brisbane apartments increased by nearly 11% from $450,000 in 2021 to $499,000 in 2023.

And what alterations might the city undergo in preparation for the 2032 Brisbane Olympics? The equity you can accumulate over time is something else to take into account when purchasing a property. The difference between the value of your home and the amount you still owe on your mortgage is known as equity. The greater your equity, the more financial freedom you have to take out loans, make investments in other assets, or make home improvements.

Due to their greater potential for capital development and enhancement, homes often have higher equity than apartments. However, if an apartment is well-maintained, well-located, and well-managed, it can also increase in value. The decision between an apartment and a house ultimately comes down to your objectives and unique circumstances. You must evaluate the advantages and disadvantages of each choice to determine which is best for you. There is no right or wrong response because both kinds of qualities have benefits and drawbacks.

The most crucial thing is to conduct thorough research, evaluate various marketplaces and properties, and, if necessary, consult a professional.

If you have any questions or need further assistance, please contact us today. You can also browse our other blog posts for topics that may be of interest to you.

Funded Futures Financial Services Socials

This website may contain general advice, but does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. In the event that Funded Futures Financial Services is providing personal advice it will be communicated via a ‘statement of advice’.

Funded Futures Financial Planning ABN 81 646 656 804 T/A Funded Futures Financial Services is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licencee # 512550.