Access advice to guide your steps

[et_pb_section fb_built=”1″ _builder_version=”3.22″][et_pb_row _builder_version=”3.25″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.25″ custom_padding=”|||” custom_padding__hover=”|||”][et_pb_text _builder_version=”4.6.0″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” hover_enabled=”0″ sticky_enabled=”0″]

Updated 13/11/2023 due to legislation change:

Increasing the Commissioner of Taxation’s authority to modify and withdraw requests for FHSS schemes. Permitting people to change or withdraw their requests before being given an FHSS scheme amount, and enabling those who do so to reapply for FHSS scheme releases later on; confirming that the Commissioner can return the released FHSS scheme amounts to super funds, as long as the money hasn’t been disbursed to the person in question.

Clarifying clearly that the cash returned to super funds are considered non-assessable non-exempt income by the funds and are not deducted against the contributor’s cap on contributions.

The changes will take effect on September 20, 2024.

——-

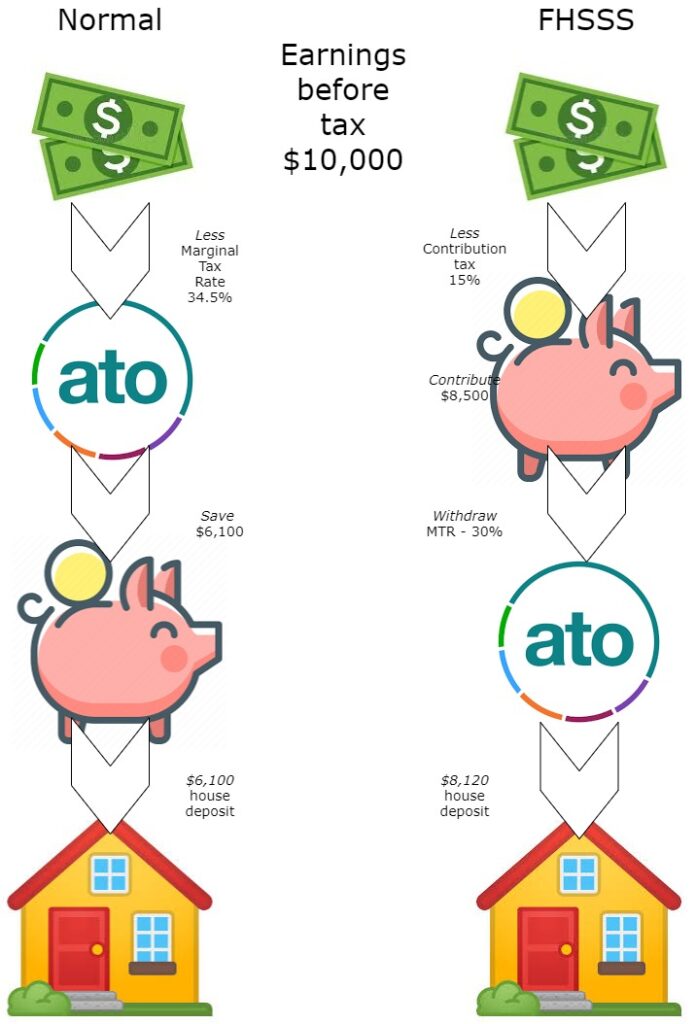

The First Home Super Saver Scheme (FHSSS) has been around for a few years now, and as bank rates continue to remain low, the FHSSS can be an effective tool to save for your home.

To be eligible for the FHSSS you just need to have never owned any previous property in Australia. Please click the following link to find everything you need Click here to read more.

You can request a withdrawal after the offer has been submitted, but you must make sure the determination is accurate and make changes if necessary. You must get the determination prior to making an offer on a property. After that, you have 28 days to notify the Australian Tax Office (ATO) that you have a contract.

You are able to contribute up to $15,000p.a for a maximum saving of $50,000 using your superannuation. This is done via either Salary Sacrifice which pays 15% tax instead of your marginal tax rate, or contributing with after tax money, that does not pay tax entering super, but had already paid tax at your marginal rate.

Once your money is inside super its ‘growth’ rate is set by the ATO which is 90 day bank bill rate + 3%. This rate is guaranteed, even though your superannuation balance will fluctuate depending on how it is actually invested.

Once you have saved your deposit (remember $50,000 max contribution) you let the ATO know that you are going to purchase your first home, and they calculate how much you have contributed plus what it has earnt (at the 3% + 90BBR), they withhold your estimated marginal tax rate less a 30% offset.

From here you have 12 months from release to purchase your first home without incurring penalties.

So how much extra could you save for your first home?

Tax differential on $1,000 of pre-income tax (not including return of income vs bank rate)

| MTR + Medicare | 21% | 34.5% | 39% | 47% (excl. earning > $250,000) |

| Cash in hand (if not using FHSSS) | 790 | 655 | 610 | 530 |

| Salary Sacrifice | 1,000 | 1,000 | 1,000 | 1,000 |

| Contribution Tax | -150 | -150 | -150 | -150 |

| Withdrawal less 30% offset | 77 | -38 | -76 | -144 |

| Cash available for home deposit | 927 | 812 | 774 | 706 |

| Value on $30,000 deposit | 4,095 | 4,704 | 4,905 | 5,265 |

If you want help saving for your first home please get in contact with us at Funded Futures Financial Services.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

This website may contain general advice, but does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. In the event that Funded Futures Financial Services is providing personal advice it will be communicated via a ‘statement of advice’.

Funded Futures Financial Planning ABN 81 646 656 804 T/A Funded Futures Financial Services is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licencee # 512550.