Access advice to guide your steps

The Gold Train: Has It Already Left the Station?

Gold has been shining brightly in recent months — and not just in jewellery stores. Since August, investors who bought gold have seen prices jump around 20%, with some gold mining companies, such as Newmont, rising even higher — up roughly 40%.

These returns have outpaced shares, tech stocks, and even Bitcoin. So it’s no surprise many investors are asking: “Have I missed the gold train?”

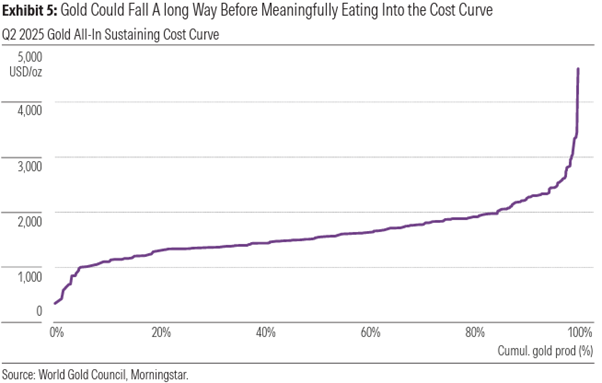

Despite the surge, long-term market analysts at Morningstar haven’t changed their base forecast: a US$2,000 per ounce long-term gold price. This figure is based on what it costs to produce gold sustainably — not short-term enthusiasm or market speculation.

It’s a good reminder that while the price of gold can move quickly, expectations also change quickly. Gold often shines brightest when uncertainty dominates the headlines — and that’s a story as old as modern markets themselves.

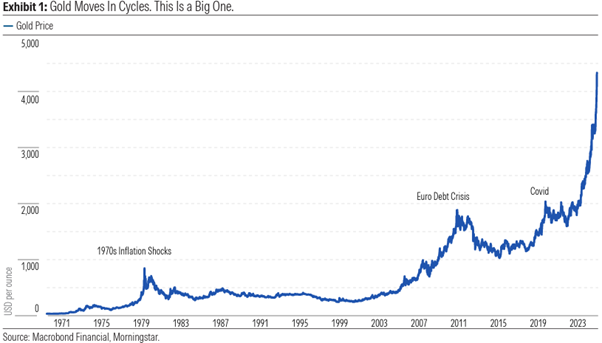

A Look Back: Gold’s Past Booms and Busts

Gold doesn’t behave like other commodities. It’s not tied to economic cycles in the same way as oil, copper, or wheat. Instead, it’s often seen as a “safe-haven” asset — a place investors run to when they lose faith in policy makers or fear financial instability.

Morningstar highlighted three major gold surges over the past 50 years:

In short, gold thrives when trust in policy falters — and falls when calm returns.

Signs of a Peak?

No one can predict the top of the cycle, but Morningstar noted some familiar warning lights flashing.

With gold prices well above the cost of production, any sharp correction could be steep — as seen when prices fell 5% in just one day recently.

Could Gold Still Climb Higher?

It’s possible.

The US government’s ballooning debt, expensive share markets, and ongoing geopolitical uncertainty all make gold appealing as a hedge. Investor enthusiasm remains strong, and momentum could keep pushing prices higher for a while.

But history shows that each gold boom eventually cools when stability returns. Gold is a powerful diversifier, not a guaranteed profit engine — and right now, it’s trading at a premium.

The Takeaway

Gold has a long history of dazzling runs followed by reality checks. Whether you already hold gold or are tempted to jump aboard, remember:

The “gold train” might have left the station for this cycle — but in markets, there’s always another journey ahead.

This website may contain general advice, but does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. In the event that Funded Futures Financial Services is providing personal advice it will be communicated via a ‘statement of advice’.

Funded Futures Financial Planning ABN 81 646 656 804 T/A Funded Futures Financial Services is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licencee # 512550.