Access advice to guide your steps

When you’re young, healthy, and busy building your career or raising a family, insurance might not be the first thing on your mind. You’ve probably ticked off the basics — life cover in super, maybe income protection.

But there’s one type of insurance that too many Australians overlook: trauma insurance, also known as critical illness cover.

Trauma insurance pays a lump sum, tax-free benefit if you’re diagnosed with a serious medical condition listed in your policy. Common conditions include:

Cancer

Heart attack

Stroke

Major head injury

Multiple sclerosis

Organ transplant

Unlike income protection, you don’t need to stop working to claim. The payout happens on diagnosis of a covered condition — giving you financial breathing room at the exact moment life gets turned upside down.

If you’ve got a mortgage, car loans, and little mouths to feed, your finances can feel finely balanced. One big medical event can throw everything off track:

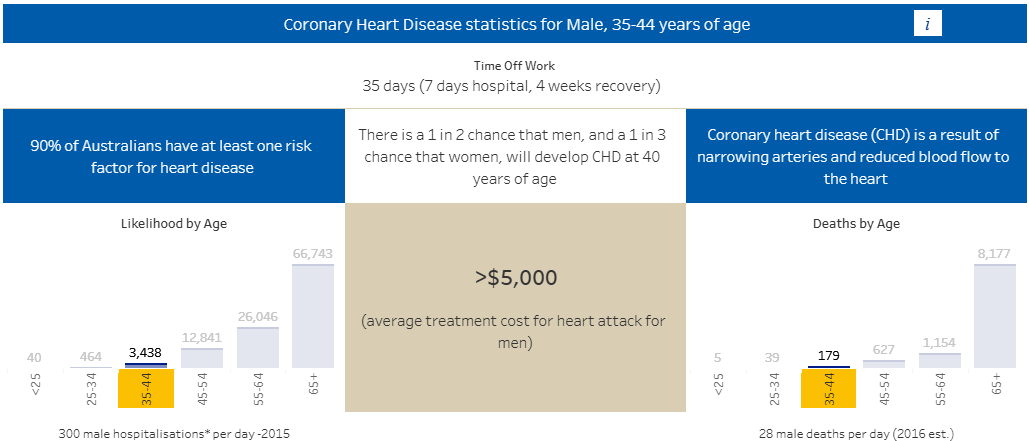

Medical costs: Even with Medicare and private health, there can be significant out-of-pocket expenses for treatment, medication, or rehab.

Time off work: You may need to step back from work to focus on treatment and recovery. A partner might need to reduce hours to care for you.

Lifestyle adjustments: You may need to hire help around the house, pay for childcare, or make home modifications.

A trauma payout provides a lump sum that you can use however you need — paying down the mortgage, covering bills, or simply taking the financial stress out of recovery.

That’s exactly the point. Serious illness doesn’t discriminate. The reality is that many trauma claims are made by people in their 30s and 40s — right in the middle of raising families and building wealth.

The other reality? Trauma cover is more affordable when you’re younger and healthier. Securing cover early can lock in protection at a time when it’s most critical.

Think of trauma insurance as a financial shock absorber. Without it, a diagnosis could derail years of financial progress. With it, you can keep your long-term goals — like paying off the family home or saving for your kids’ future — on track.

For young families, trauma insurance isn’t a luxury — it’s an essential part of protecting the future you’re working so hard to build.

At Funded Futures, we believe in building financial plans that stand up to life’s surprises. If you’d like to understand how trauma insurance fits into your protection strategy, get in touch with our team today.

This website may contain general advice, but does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. In the event that Funded Futures Financial Services is providing personal advice it will be communicated via a ‘statement of advice’.

Funded Futures Financial Planning ABN 81 646 656 804 T/A Funded Futures Financial Services is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licencee # 512550.